Column

2022年09月25日

Flood risk assessment methods and data accuracy required for TCFD disclosure

In recent years, TCFD has been rapidly attracting attention. It is a forerunner of information disclosure on risks due to climate change, which is becoming semi-essential for listed companies, and as of September 2022, many sustainability-related risk assessment methods have been created based on this TCFD recommendation. This article explains the basics of TCFD that companies should undertake and how to assess flood risk, which has a large impact among risks.

What is TCFD?

The TCFD stands for “Task Force on Climate-related Financial Disclosures” and is one of the groups created within the United Nations Financial Stability Board. This group will publish its final report in June 2017, and its contents will be commonly referred to as the “TCFD Recommendations.” The members are mainly members from globally influential investment firms and insurance companies, and the chairman is Bloomberg. The recommendations call for companies to disclose climate-related risks to themselves. It is necessary to simulate the future in which climate change occurs (such as a rise in the average temperature of 2 degrees Celsius) and quantitatively evaluate and announce the impact on corporate activities. Banks and insurance companies will look at the disclosures to determine whether the company is doing business that can respond to climate change and make investment and underwriting decisions. In other words, the ability to respond to climate change has become a new indicator of a company’s future growth and financial health.

Threats Posed by Climate Change: Physical Risks

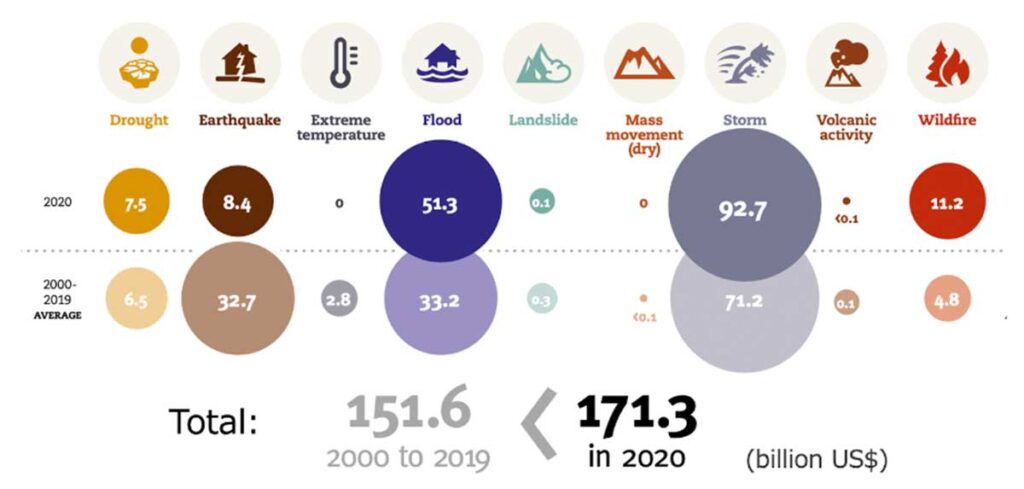

In recent years, abnormal weather such as heavy rains, typhoons, and forest fires, which can smell the effects of climate change, have occurred in various parts of the world. As global warming progresses further in the future, it is expected that such dramatic changes in weather will continue to occur, and companies need to manage climate change as their own risk. Not only that, but if greenhouse gases in corporate activities are left unchecked, they are contributing to the worsening of climate change and are taking liability risks. Therefore, it is also necessary to reduce future climate risks through corporate activities, and those activities themselves are also subject to evaluation such as investment.In recent years, abnormal weather such as heavy rains, typhoons, and forest fires, which can smell the effects of climate change, have occurred in various parts of the world. As global warming progresses further in the future, it is expected that such dramatic changes in weather will continue to occur, and companies need to manage climate change as their own risk. Not only that, but if greenhouse gases in corporate activities are left unchecked, they are contributing to the worsening of climate change and are taking liability risks. Therefore, it is also necessary to reduce future climate risks through corporate activities, and those activities themselves are also subject to evaluation such as investment.

How to assess climate physical risks

Methods for assessing physical risks in the climate have evolved over the past few years. Various indicators related to climate change, such as floods, typhoons, heat waves, and water shortages, are major research fields as research fields. With a lack of understanding of natural disasters and abnormal weather situations, future projections of climate change are included, so it is difficult to accurately evaluate them. Even so, using the research data accumulated in the field of climate change, evaluation methods have been gradually developed. At Japan, using data created by various research institutes, the Ministry of the Environment has been taking the lead in formulating its methods.

Physical risks are classified into “chronic risks” such as rising average temperatures and rising sea levels, and “acute risks” such as natural disasters arising from chronic risks. Depending on the type of business a company, the effects of climate change can manifest themselves in different ways. Manufacturers of automobiles and appliances will need to focus on acute risks such as flooding and storm surges. On the other hand, if you are a company that deals with food, it is necessary to analyze not only acute risks but also changes in chronic risks such as temperature, precipitation, and solar radiation, since the agricultural products used as raw materials are greatly affected by daily weather. Although each risk is assessed differently Japan this article describes in more detail the flood risk assessment methodology, which has the largest damage in the country.

How to assess flood risk

Floods are natural disasters that have been in the Japan for a long time, but there are concerns that risks will increase in the future due to the effects of climate change. Due to the large number of flood occurrences, flood hazard maps are also prepared nationwide, so risk assessment methods are also evaluated in detail by materials from the Ministry of the Environment and the Ministry of Land, Infrastructure, Transport and Tourism. The lecturer briefly explains the methods described in the latest assessment method as of September 2022, “Practical Guide to Scenario Analysis of Climate Change Risks and Opportunities in Line with the TCFD Recommendations (for the Banking Sector) ver.2.0″[2].

The process for quantitatively assessing physical risk is as follows:

- data collection

- Analysis of expected damage (inundation depth)

- Analysis of expected damages (financial impacts)

- Risk Assessment and Countermeasures as a Company

1.Data Collection

We will prepare two types of data: data of your company and related parties, and flood data.

Company data includes location, assets, turnover, and number of employees.

Flood data is data from so-called “hazard maps.” In Japan, Japan there is a nationwide hazard map prepared by the Ministry of Land, Infrastructure, Transport and Tourism and a GIS tool “Overlaying Hazard Map” [3] that can be easily analyzed. However, when going overseas, it is almost always difficult to obtain and use data, and flood risk assessment remains a challenge.

2.Analysis of expected damage (inundation depth)

By superimposing the target point information on the hazard map, the inundation depth is analyzed in the event of a flood at that location. The hazard map of the Ministry of Land, Infrastructure, Transport and Tourism is made assuming a flood once in 1000 years. It has a horizontal resolution of 5 m, and the map is carefully made one for each river in the whole country, so it is highly reliable. Therefore, it is important to keep in mind that this data can only be used to address the once-in-a-millennium flood.

3.Analysis of Anticipated Damages (Financial Impacts)

Once you know the depth of inundation caused by a flood, you can analyze the quantitative impact of a company on its properties. Since it is not an actual impact, it is difficult to predict exactly, but as long as there is a certain degree of accuracy as a disclosure of information for investors and the market, there will be no problem (specialized companies such as non-life insurance companies have know-how for more detailed quantitative evaluation).

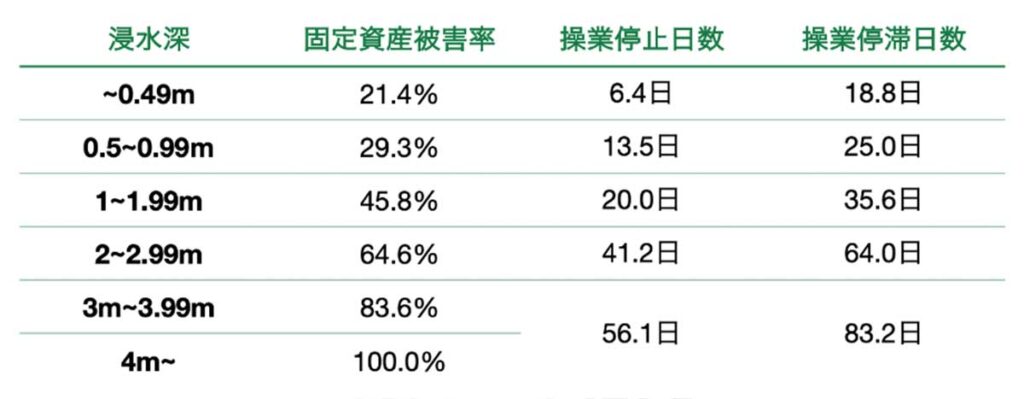

If the inundation depth is obtained, it is possible to quantitatively analyze the damage rate to assets and the impact on sales. The Ministry of Land, Infrastructure, Transport and Tourism publishes average figures on assets and the impact on business start-ups relative to the inundation depth, and it can be calculated using that function.

The figures that appear in this analysis are the impact of floods on a scale that occurs once every 1,000 years. The TCFD requires quantitative assessment of smaller but more frequent floods and the impact of floods if climate change progresses. However, high-resolution flood hazard maps that take into account the effects of climate change are not available for free. However, due to the recent trend of disclosure of sustainability information, financial institutions are actively seeking such flood risk information, and firms are forced to make efforts and devise ingenuity.

4.Risk Assessment and Countermeasures as a Company

Ultimately, it is important for the company as a whole to assess how large the flood risk is to assets and sales. The higher the number of flood risk sites, the more vulnerable it is to heavy rains, and may be seen as vulnerable to climate change.

On the other hand, even in areas with a high flood risk, it is possible to reduce damage by installing water stop boards and formulating BCPs (business continuity plans). If it can be logically explained that even if a flood actually occurs, it will have little impact on corporate performance, it will be a reassuring material for managers and investors. Since the damage function shows the average impact of Japan buildings, it is possible to explain that a company is resilient to climate change by reflecting the company’s efforts to address it.

How to assess the effects of climate change

In TCFD disclosures for financial institutions, “climate scenario analysis” is important information. In line with greenhouse gas emissions, the future average temperature rise of the earth at the end of the 21st century will change in the range of 1.0 to 5.7 degrees Celsius. Since the susceptibility to abnormal weather changes as the temperature rises, companies are required to clarify the respective situations of transition risk and physical risk through scenario analysis.

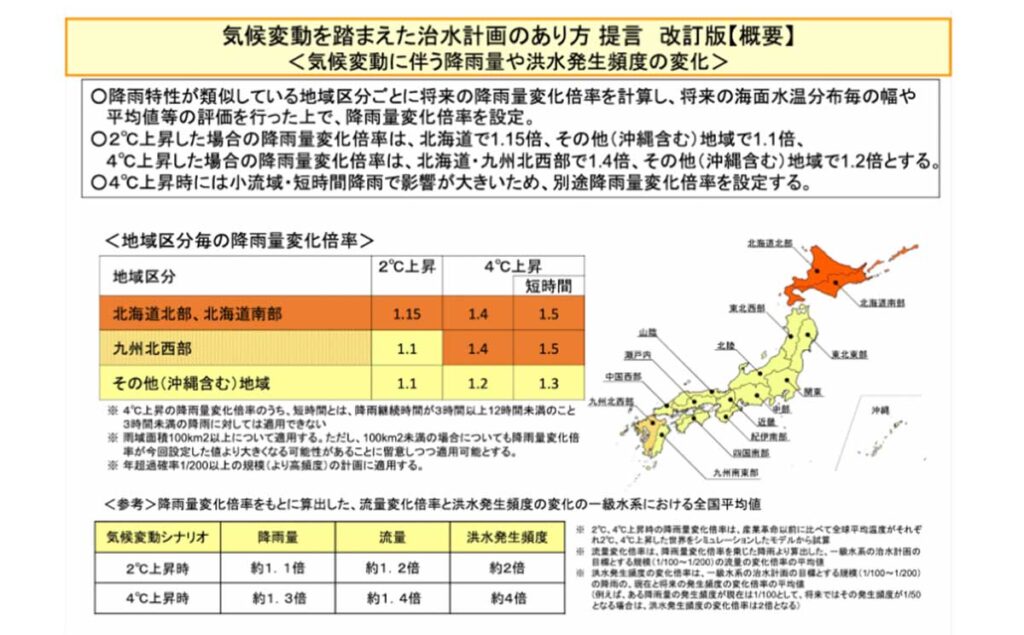

Phenomena such as heavy rains and typhoons that cause flood risk are also changed by climate change. The Ministry of Land, Infrastructure, Transport and Tourism (MLIT) has announced the amount of changes in flood risk due to future climate change, and this data can be used for TCFD analysis. However, it is not written how much the essential inundation depth will change, and it cannot be used directly for risk analysis, so be careful how this number is used.

Climate Risk Analysis Application Climate Vision

The climate risk analysis application “Climate Vision” developed by Gaia Vision Co., Ltd. is a web service that can easily perform this flood risk analysis. Although it is currently in beta, it is a revolutionary solution that can significantly reduce the burden of TCFD analysis for enterprises at a low price. Flood risk data created using state-of-the-art simulation technology can be analyzed not only in Japan but also around the world (climate scenario analysis and financial impact assessment capabilities will be added around winter). We also publish papers on data, ensuring the transparency of data required by TCFDs and other sources.

We often hear that sustainability professionals are overwhelmed with enormous workloads on a daily basis and are unable to assess physical risks. On the other hand, weather disasters such as Typhoon No. 14 are expected to occur frequently in the future, so it is essential to advance the assessment of physical risks as much as possible and take countermeasures as soon as possible.

If you have any problems analyzing or disclosing information on climate change risks, please contact us.

Bibliography

- UNDRR, 2021: 2020 The non-COVID year in disasters,

https://www.undrr.org/publication/2020-non-covid-year-disasters, on June 11, 2021 - Ministry of the Environment, 2022: Practical Guide to Scenario Analysis of Climate Change Risks and Opportunities in Accordance with TCFD Recommendations (for the banking sector) ver.2.0,

https://www.env.go.jp/content/900518880.pdf, on 25 April 2022 - Geospatial Information Institute: Hazard Map,

https://disaportal.gsi.go.jp/maps, Viewed on 2022/08/10 - MLIT, 2018: 【Overview】Proposal for Flood Control Plans Based on Climate Change Revised Edition, https://www.mlit.go.jp/river/shinngikai_blog/chisui_kentoukai/pdf/r0304/00_gaiyou.pdf, Viewed on May 21, 2021

News

- 2024年10月03日 Gaia Vision releases beta version of its flood forecasting solution “Water Vision”

- 2024年09月19日 Gaia Vision is listed in “Summary of Recommended DX Service and Solution Providers”.

- 2024年09月10日 Gaia Vision is listed in “Summary of Recommended DX Service and Solution Providers”.

- 2024年05月10日 Gaia Vision is listed in “Summary of Recommended DX Service and Solution Providers”.

- 2024年05月01日 Gaia Vision is listed in “Summary of Recommended DX Service and Solution Providers”.

Column

-

-

-

-

-