Column

2024年02月21日

(Quick Commentary Article) Banks’ Obligation to Disclose Climate Change Risks (from Nikkei article)

Last week, the following article appeared on the front page of the Nikkei newspaper.

In the next 26 years, banks in major countries will be required to disclose information on their loans and emissions by industry, and to visualize potential risks.

https://www.nikkei.com/article/DGKKZO78520610W4A210C2MM8000/

The purpose of the article is to request that the FSA (national financial authorities) require financial institutions to further assess and disclose potential risks related to physical risks (e.g., flood risk) and transition risks. The main thrust of this article is twofold

- Regarding physical risk: In view of the possibility of damage to plant and equipment in companies financed that could be affected by river flooding, which could lead to shutdown of operations and a reduction in the value of collateral, disclosure of loan amounts and provisions for losses is required.

- Transition risk: In the process of transitioning to a decarbonized society, environmental regulations could require banks to cut back or even eliminate operations in industries that emit large amounts of greenhouse gases, which would damage them. In anticipation of this, banks are required to disclose detailed information on the size of loans by industry and reserves for possible loan losses.

Presumably, this article is based on the consultation document on “Climate-related Financial Risk Disclosure” issued by the Basel Committee on Banking Supervision (BCBS) last November (2023), rather than on any recent new standard.

h ttps:// www.bis.org/bcbs/publ/d560.pdf

*Basel Committee on Banking Supervision, “Consultative document – Disclosure of climate-related financial risks” (2023/11).

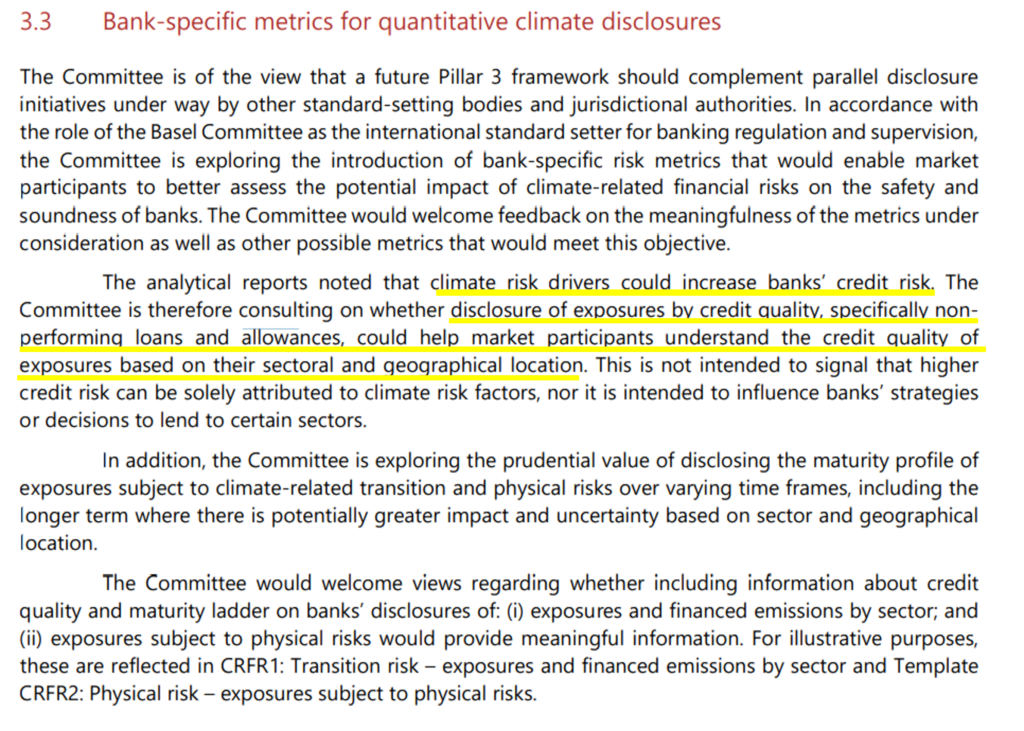

For example, on page 6, there is a section titled “Quantitative Metrics for Bank-Specific Climate Disclosures,” which states that “Climate risk can increase a bank’s credit risk, and the Basel Committee is proposing to disclose provisions and other disclosures for geographically/sectorally geophysically risky entities in order to help market participants understand the potential for climate risk to increase. The Basel Committee on Banking Supervision is proposing whether or not to disclose reserves and other disclosures for geographically/sectorally risky entities in order to help market participants understand the risks involved.

The premise is that this Basel Committee on Banking Supervision report is positioned as complementary with the financial industry in mind, while other frameworks are being discussed with regard to climate risk disclosure, with the ISSB in the lead. We believe that the description of this area is a typical example of this.

1. background on risk assessment/disclosure in the financial industry

The risk assessment and information disclosure in the financial industry has been progressing through a process of trial and error over the past several years, with various reports and experimental stress tests being conducted. We would like to briefly summarize the background of this news and related developments.

1-1. Summary of Background

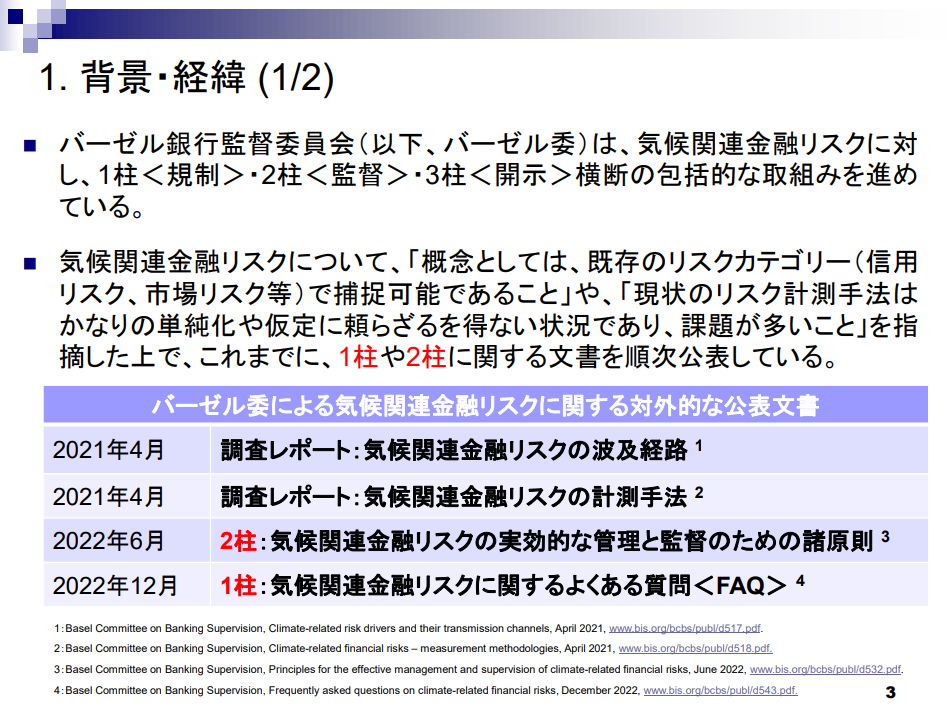

First, this document from the FSA summarizes the Basel Committee on Banking Supervision’s November 2023 text on climate-related financial risk disclosure.

https://www.fsa.go.jp/inter/bis/20231201-1/01.pdf

*Financial Services Agency, “Publication of the Basel Committee on Banking Supervision’s Consultative Document on Disclosure of Climate-related Financial Risks” (2024/1)

This document may give you a rough background understanding, but we will provide some additional information below.

This type of movement started in the financial industry after the financial crisis of 2008, when there was a movement to properly manage ESG risks in order to prevent such a crisis from happening again. This is based on the idea that ESG risks, including climate change, have the characteristics of systemic risks that could lead to a financial crisis, and led to the Financial Stability Board (FSB) launching the Task Force on Climate-related Financial Disclosures (TCFD) in 2015.

Below are related articles from our past

https://www.gaia-vision.co.jp/column/979/

*What is required of the financial community and banks to manage climate change risk? (2023/2)

https://www.gaia-vision.co.jp/column/700/

*Sorting out trends in discussions on information disclosure and sustainable finance (2022/9)

The movement itself, as described in the Nikkei article, is not brand new, but rather an extension of a larger framework that has been presented for some time and is now gradually being fleshed out.

1-2. 2014, ICMA Green Bond Principles.

The ICMA* Green Bond Principles were released in 2014. *ICMA: International Capital Markets Association

This is somewhat separate from the current disclosure discussion, but it is a parent principle for green bonds, which are preferential loans that are tied to some “green” use. The related principles that follow are based on these principles. The Green Bond Principles are composed of elements such as “green project evaluation/selection process,” “procurement fund management,” and “reporting,” but the most significant element is the “use of procured funds,” which indicates the “green” target category. The five environmental objectives ((1) climate change mitigation measures, (2) climate change adaptation measures, (3) conservation of the natural environment, (4) biodiversity conservation, and (5) pollution control) are defined here.

https://greenfinanceportal.env.go.jp/bond/related_info/principle.html

*Reference: Ministry of the Environment, Green Finance Portal, “Green Bond Principles

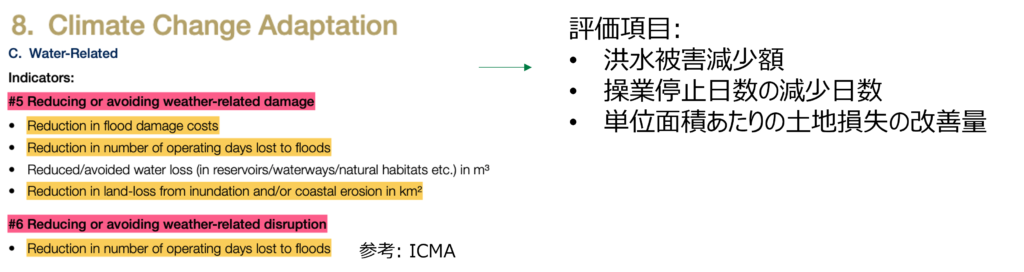

Among ICMA’s proposals is one that states that if a bond is issued within the framework of “climate change adaptation,” the amount of reduction in flood damage, etc., should be assessed (this is considered more of an example than a mandate).

1-3. 2017, NGFS

NGFS will be established in 2017. *NGFS: Network of Financial Authorities for Climate Change Risks, etc.)

The NGFS is a TCFD for financial institutions and is used by financial institutions for risk management and information disclosure based on the NGFS, which provides more specific tools than the principles issued by the Basel Committee on Banking Supervision, such as scenario development for stress testing by central banks. The NGFS also provides more specific tools than the principles issued by the Basel Committee on Banking Supervision.

2. . Recent Developments in Risk Assessment/Disclosure in the Financial Industry

Below are developments in the last few years that we consider particularly important. We believe that there are two major points

- “Publication of a document from the Basel Committee on Banking Supervision on climate-related financial risks (story directly related to today’s Nikkei article).”

- Examples of actual risk assessment and disclosure initiatives by financial authorities and financial institutions in various countries.

2-1. Methodology published by the Basel Committee on Banking Supervision in 2021.

The publication of the text from the Basel Committee on Banking Supervision is summarized in the material from the Financial Services Agency mentioned above.

2021/4 Climate-related financial risks measurement methodologies published

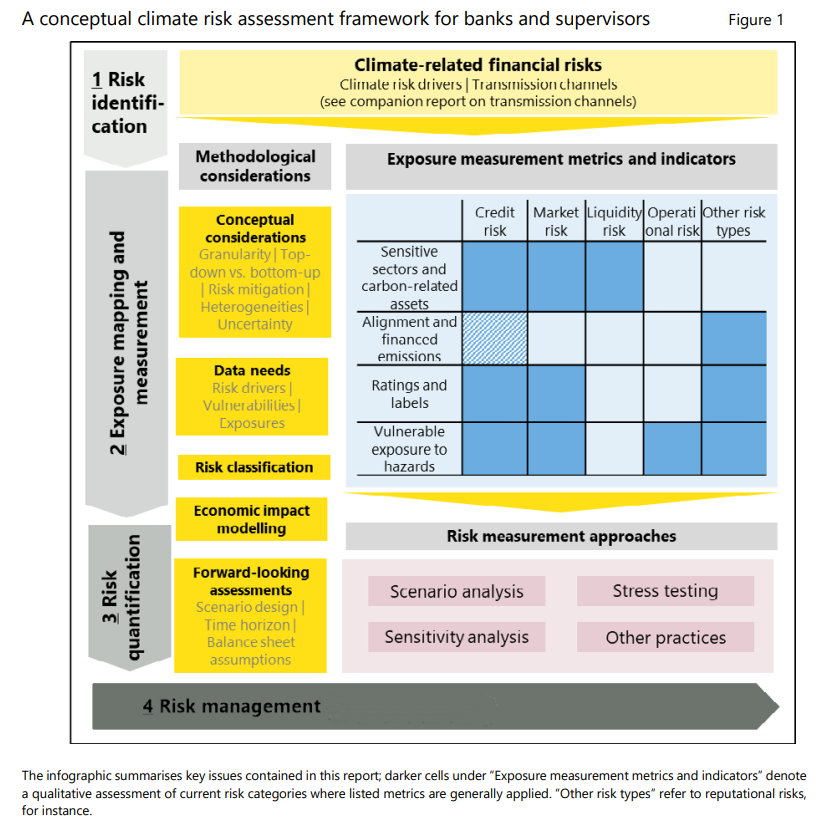

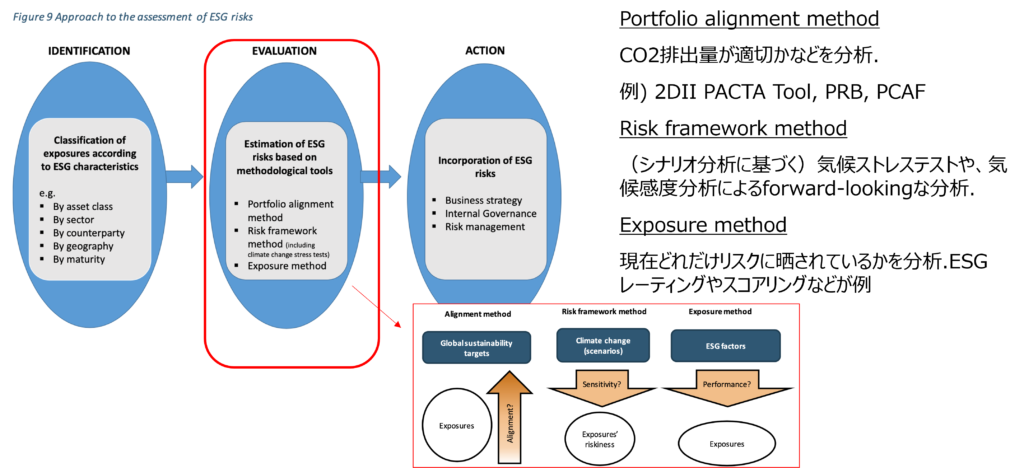

A methodology for climate-related risk measurement methods has been published here. The major framework was defined here. The most commonly seen diagram is shown below. Scenario analysis and stress testing are mentioned here.

2-2. Report published by EBA (European Banking Authority) in June 2021

2021/6 EBA Report on ESG risk management and supervision

Shortly after the Basel Committee on Banking Supervision issued its methodology report, the EBA (European Banking Authority) also issued a report on bank risk management and supervision. The main purpose and content of the report seems to be similar to that of the Basel Committee on Banking Supervision, but I believe that it has been positioned to be more relevant to regional financial authorities. The main framework of the report is organized as Identification > Evaluation >Actiont, and the Exposure Method is included in the Evaluation.

2-3. 2021-2022, pilot stress tests from various countries

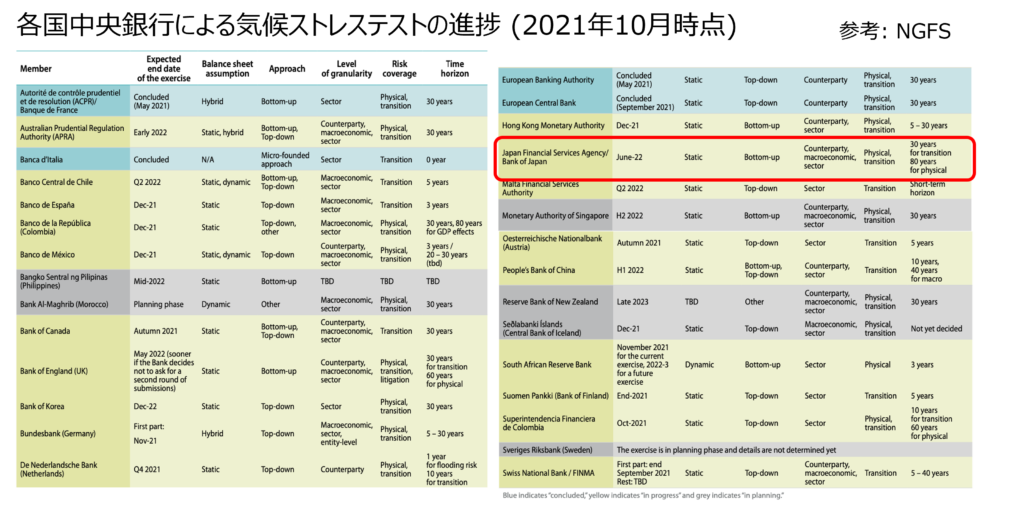

With the above developments as a backdrop, stress tests were being conducted on a trial basis at many central banks from 2021~2022. Many banks were conducting stress tests using the NGFS scenario established in 2017. The Bank of Japan also stated below that it plans to conduct the tests by July 2022 (as of 2021/10), and the results were actually released in August 2022.

2-4. June 2022, Basel Committee on Banking Supervision publishes principles on “supervision (Pillar 2)”.

2022/6 Basel Committee on Banking Supervision publishes Principles for the Risk Management of Financial Institutions (Principles for the Effective Management and Supervision of Climate-related Financial Risks)[Pillar 2]

As noted above, the published text from the Basel Committee on Banking Supervision was supposed to consist of three pillars. This text is positioned as Pillar 2 and contains the principles of what the supervisory authorities require of commercial banks.

- Pillar1. regulation

- Pillar2. Director (← this book)

- Pillar3. disclosure (legal)

(Reference) https://www.pwc.com/jp/ja/knowledge/column/finance/climate-related-financial-risks.html

*PwC, “Consideration of the initiatives required of the banking industry in light of the Basel Committee on Banking Supervision’s publication of the Principles for the Effective Management and Supervision of Climate-related Financial Risks” (2022/9).

2-5. Stress test released by ECB (European Central Bank) in July 2022

2022/7 The “2022 Climate risk stress test” was published at the ECB (European Central Bank).

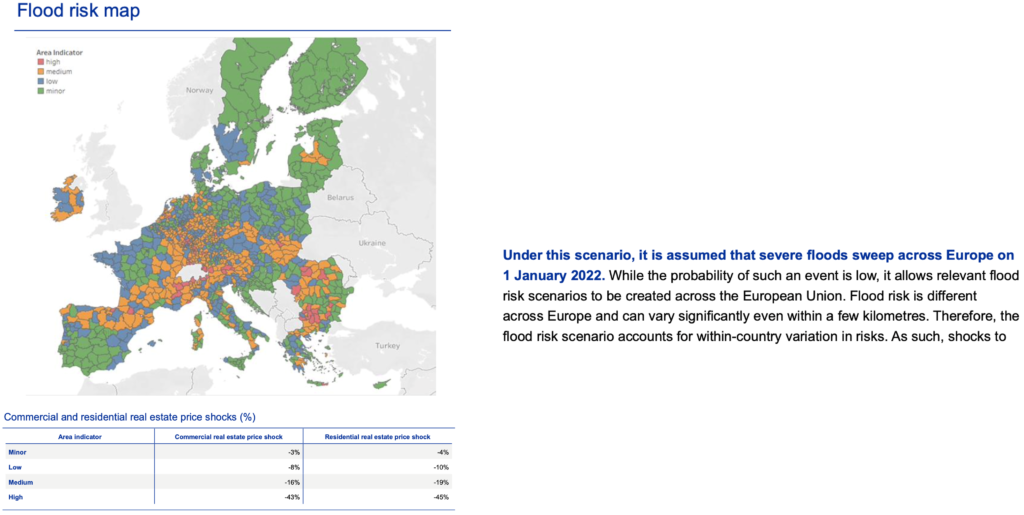

This report presents the results of a stress test focusing on the climate change risks facing the EU banking sector. It aims to assess the potential impact of climate change on the financial system and examine how banks are addressing these risks.

While this is a useful pilot effort to start with, the coarseness of the assessments is recognized as a challenge. For example, some assessments remain categorical, as shown in the figure below for flood risk.

(Reference) https://www.bankingsupervision.europa.eu/ecb/pub/pdf/ssm.climate_stress_test_report.20220708~2e3cc0999f.en.pdf

ECB “2022 climate risk stress test” (2022/7)

2-6. Scenario analysis conducted and published in Japan in August 2022

2022/8 Pilot scenario analysis in Japan with the Bank of Japan and 3 megabanks/3 mega non-life insurers

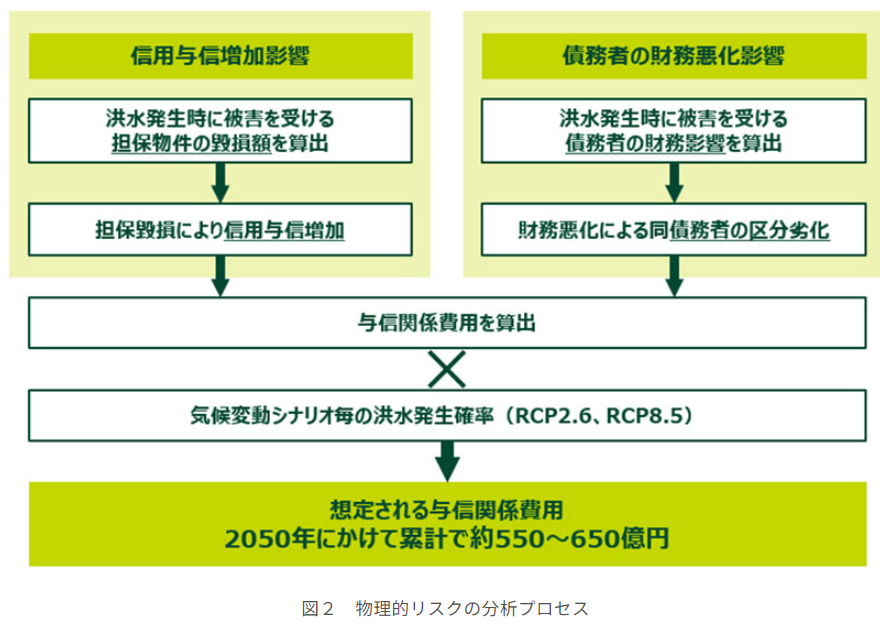

The results of the scenario analysis are presented on a trial basis, making various assumptions. For example, the analysis of water damage risk is based on the assumption that a specific point is breached, and the extent of the impact is shown. On the other hand, the report also mentions technical constraints and limitations in terms of accuracy, suggesting future issues to be addressed.

(Reference) https://esgjournaljapan.com/domestic-news/20750

*Financial Services Agency and Bank of Japan collaborate with major megabanks and non-life insurance companies to conduct climate-related scenario analysis.

In 2019, Sumitomo Mitsui Banking Corporation, for example, became the first global financial institution to disclose the amount of assumed physical risk based on climate change scenario analysis. In fiscal 2021, the Bank expanded the geographic scope of physical risk analysis from Japan to the global market.

https://adaptation-platform.nies.go.jp/private_sector/tcfd/report/report_005.html

2-7. In December 2022, the Basel Committee on Banking Supervision issued a text on “Regulation (Pillar 1)”.

It clarifies how climate-related financial risks should be captured within the scope of current standards for several rules of the Basel framework related to relevant risk categories (credit, operational, market, and liquidity) (it is not an amendment or modification of the Basel rules). This document is intended to facilitate the implementation of an internationally consistent Basel framework by requiring banks to continue to upgrade their risk measurement methods and reduce risk, while allowing flexibility in implementation.

2-8. NGFS updated in November 2023.

The NGFS scenarios have been updated with the latest economic and climate data, policy commitments, and model upgrades. In addition, some technical assumptions have been revised.

Examples of updated perspectives include

- New national policies to achieve net-zero emissions (e.g., EU Fit-for-55, US IRA (US Inflation-Reduction Act))

- Latest developments in renewable energy technologies (solar, wind, etc.) and key mitigation technologies

- For example, solar capital costs are expected to fall faster, according to new projections.

- Restrictions on the availability of carbon capture and storage (CCS) technologies will be introduced, reducing the overall availability of these technologies

- This is modeled by explicit constraints at the process level, such as setting a time-dependent maximum plantable area and a maximum annual amount of bioenergy with CCS potential

- Direct Atmospheric Carbon Capture and Storage (DACCS) technology was turned off in all scenarios due to uncertainties, especially regarding its development.

2-9. In November 2023, the Basel Committee on Banking Supervision issued a text on “Disclosure (Pillar 3)”.

In light of the above, we are pleased to announce the publication of the disclosure statement from the Basel Committee on Banking Supervision, which is probably referred to in this Nikkei article. The Basel Committee on Banking Supervision is considering a disclosure framework applicable to internationally active banks that complements the ISSB’s IFRS Sustainability Disclosure Standard (“ISSB Standard”) published in June 2023, while emphasizing interoperability with the disclosure standards of major standard setters, including the International Sustainability Standards Board (“ISSB”). We are considering a disclosure framework applicable to banks. The Basel Committee on Banking Supervision also recognizes that climate-related data is still in a developmental stage with challenges in quality and accuracy, but by setting up a disclosure framework, it aims to resolve these issues.

The Basel Committee on Banking Supervision (BCBS) has recently published a consultative document summarizing the results of its initial discussions and preliminary proposals on a disclosure framework. Against this backdrop, the Basel Committee on Banking Supervision has now finalized its initial discussions and preliminary proposals for a disclosure framework, leading to the publication of a consultative document.

*Source: https://www.fsa.go.jp/inter/bis/20231201-1/01.pdf

Financial Services Agency, “Release of the Basel Committee on Banking Supervision’s Consultative Document “Disclosure of Climate-related Financial Risks””.

3. summary

Overall, we believe that, albeit gradually, an international framework for climate change risk management is being articulated through ICMA principles and NGFS, and guidelines and initial analysis are being presented by national/regional supervisors, central banks, megabanks, etc. We believe that the international framework is being clarified through the ICMA Principles and the NGFS.

On the other hand, we have heard that in many practical cases, people find it difficult to find analytical methods and assumptions to occur. In fact, the NGFS, for example, mentions in its 2021 report that there are difficulties when trying to downscale global climate models to higher resolutions.

https://greencentralbanking.com/research/progress-report-on-bridging-data-gaps/

NGFS: Progress Report on Bridging Data Gaps (2021/1)

As reports on these “data gaps” indicate, there is certainly a need for better data (e.g., higher resolution physical risk assessments) in this area.

We believe that we and related research institutions have data that could contribute to these issues.

We hope to contribute to these efforts in any way we can by taking advantage of our technological superiority in being able to perform high-resolution simulations anywhere in the world.

We hope this will be of some help to those concerned with sustainability.

If you have any questions, please feel free to contact us.

Acknowledgment

We would like to thank Mr. Niimi of the Japan Research Institute for providing us with information on some of the contents of the FSA’s “Publication of the Basel Committee on Banking Supervision’s Consultative Document “Disclosure of Climate-related Financial Risks” (2024/1) and other materials. We would like to take this opportunity to thank him.

News

- 2025年12月16日 Gaia Vision Selected for a JICA Demonstration Project on Digital and Space Technologies for Water Resources Management

- 2025年09月01日 Our two speakers, Kita and Demoto, will be present at the talk session on September 20 at Expo 2025 in Osaka/Kansai.

- 2025年04月03日 Our technology development project as a partner organization was selected for the “Overseas Demonstration of Satellite Data Application Systems (Feasibility Study),” a technology development theme for which the Space Strategic Fund is soliciting applications from the public.

- 2025年03月07日 ADRC (Asian Disaster Reduction Center) Researchers from Asian Countries Visited Our Company

- 2025年02月21日 ADRC (Asian Disaster Reduction Center) Researchers from Asian Countries Visited Our Company

Column

-

-

-

-

-