News

2023年03月13日

[Press] Climate Change Risk Analysis Platform for Climate Scenario Analysis and Financial Impact Assessment, Climate Vision, Now Available in Official Version

– Utilizes the most advanced climate data to address disclosure demands by TCFD/ISSB, etc. –

Gaia Vision Inc. is pleased to announce the release of the official version of its climate change and flood risk management platform, Climate Vision. Usage applications has opened.

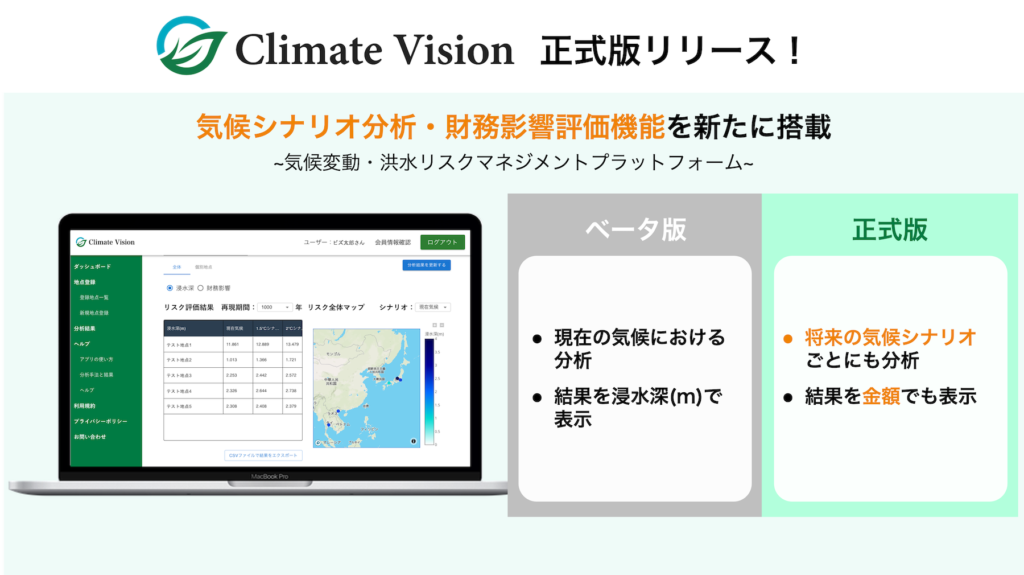

Value Provision of New Function “Climate Scenario Analysis and Financial Impact Assessment”

Climate Vision is an application for quantitative analysis of climate change risks such as floodings, and its beta version had been released in July 2022. In addition to the risk analysis function under current climate situations provided in the beta version, we have implemented future climate scenario analysis and financial impact assessment functions to the official version of Climate Vision.

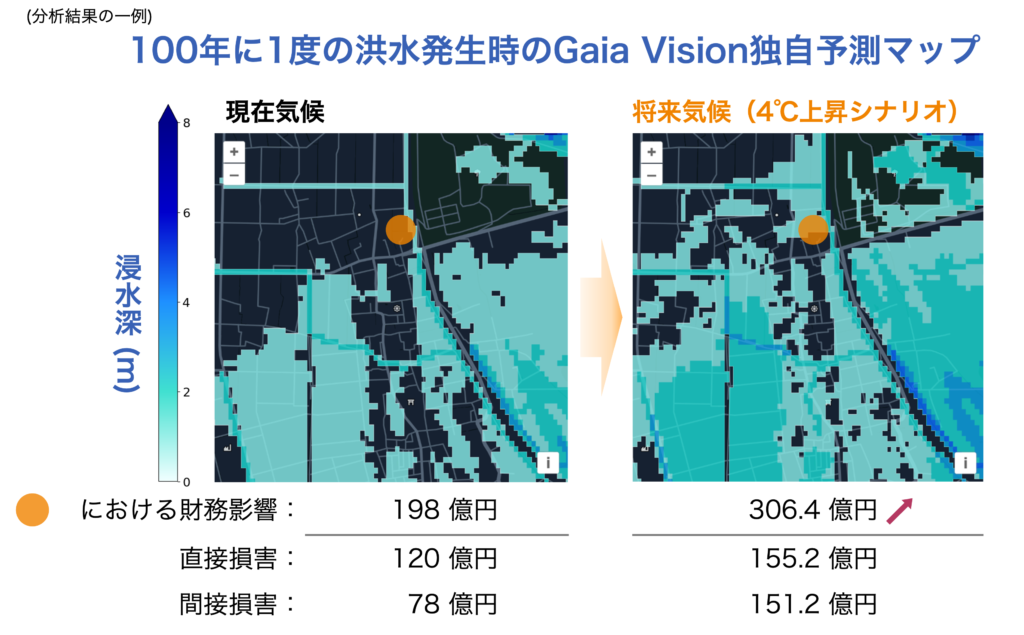

With these new functions, companies can now analyze changes in risk for their locations worldwide under common future climate scenarios of 1.5°C, 2°C, and 4°C temperature rise. In addition, risk assessment can be performed from the perspective of financial impact based on the asset value of the locations. By utilizing these functions, it is possible to easily conduct the quantitative analysis of physical risk required by the TCFD (Task Force on Climate-Related Financial Disclosures) and other organizations.

There are various data and analysis services for climate physical risk, but they have practical issues such as low resolution, difficult analysis procedures, and inability to calculate financial impact. Climate Vision offers reliability and functionality not found in other services, through the provision of high-resolution data of which accuracy has been scientifically verified and financial impact assessment.

■Background of new feature

Sustainability information is becoming increasingly important in corporate disclosures. Among these, the TCFD (Task Force on Climate-Related Financial Disclosures) is attracting increasing worldwide attention, with more than 1,300 Japanese companies endorsing the TCFD (as of February 22, 2023). The International Sustainability Standards Board (ISSB), under the International Financial Reporting Standards (IFRS), has also been discussing the requirement for companies to conduct quantitative scenario analysis. In particular, the demand towards listed companies to conduct such risk analysis and information disclosure is expected to increase in the future.

On the other hand, some corporate sustainability officers who are responsible for such analysis raise their concerns, such as “The difficulty to analyze overseas sites” and “The lack of clarity for analyzing future scenarios”. By providing a web application that enables easy analysis, we hope to reduce the burden of corporate disclosure work and gain the trust of the market.

■How to use “Climate Vision“

Climate Vision is a service for companies, financial institutions, and local governments, etc. We offer several plans depending on the number of analysis points and functions. If you are considering using our service, please contact us through our website. After having discussions with us, we will finalize the contents of the plan and issue the account necessary for the analysis.

News

- 2024年05月10日 Gaia Vision is listed in “Summary of Recommended DX Service and Solution Providers”.

- 2024年05月01日 Gaia Vision is listed in “Summary of Recommended DX Service and Solution Providers”.

- 2024年04月16日 Gaia Vision is listed in “Summary of Recommended DX Service and Solution Providers”.

- 2024年04月14日 Gaia Vision is listed in “Summary of Recommended DX Service and Solution Providers”.

- 2024年03月29日 Gaia Vision is listed in “Summary of Recommended DX Service and Solution Providers”.

Column

-

-

-

-

-