Column

2022年09月25日

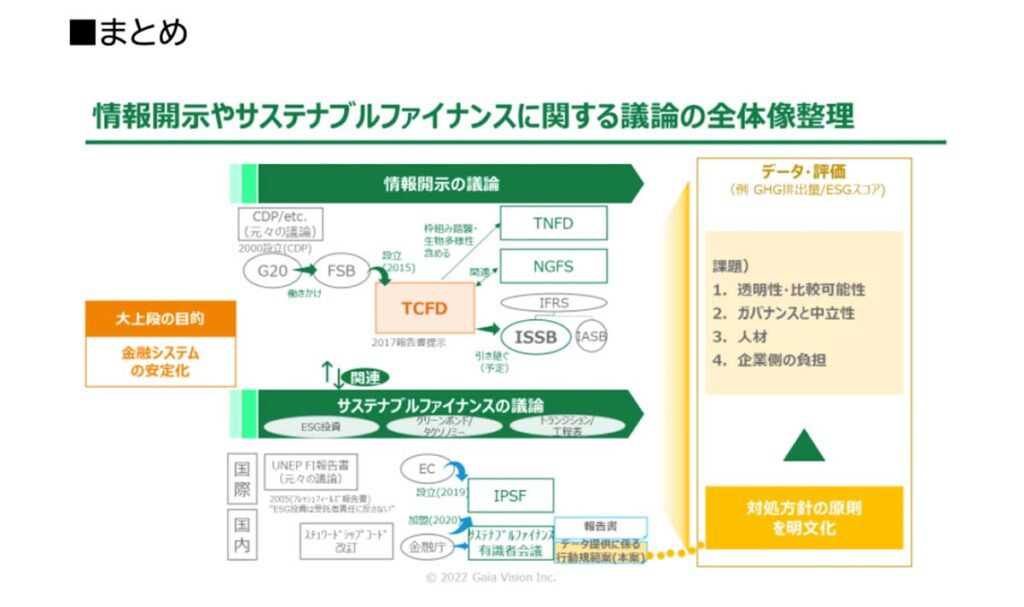

Organizing Trends in Discussions on Information Disclosure and Sustainable Finance

Discussions on climate change countermeasures are actively conducted on a daily basis, but discussions on “sustainable finance” and “information disclosure,” which aim to resolve climate change issues starting from the financial sector, are also becoming active. Sustainable finance refers to initiatives to support sustainability-related activities of companies by diverting the flow of investment and loans to “sustainable” companies. It is considered to be a concept that encompasses initiatives such as ESG investment, green bonding, taxonomy, and transition finance (details will be described later).

Recently, the following movements have been made.

- 2021/6: Financial Services Agency releases the First Report of the Council of Experts on Sustainable Finance

- 2022/6: The Financial Services Agency (FSA) publishes the “Draft Code of Conduct for ESG Assessment and Data Providers”…(*)

- 2022/7: Prime Minister Kishida proposes a policy requiring listed companies to disclose “non-financial information,” including sustainability-related initiatives

- 2022/7: Financial Services Agency releases the second report of the Expert Committee on Sustainable Finance

In this way, rule-making on sustainable finance is currently underway, and it is expected to have a certain impact on companies. On the other hand, I have the impression that there are many difficult contents for the general public (e.g. “What is the difference between sustainable finance and transition finance?”). In this article, I would like to summarize the recent trends in discussions on sustainable finance and the discussions on data providers.

1. Sorting out keywords related to information disclosure related to climate change risks

First of all, I would like to organize the basic understanding of keywords related to information disclosure, such as TCFD. TCFD stands for Task force on Climate-related Financial Disclosures = Climate-related Financial Disclosures, and is a framework that encourages companies to disclose climate-related information.

I think that TCFD is relatively well known, but there are really various other keywords flying around (SBT/NGFS/TNFD/AR3T/CA100+ETC.), so I would like to organize it around TCFD.

What is TCFD?

- Final report presented in 2017

- G20 Reaches Out to FSB, FSB Established (Chaired by Bloomberg Founder)

- Composition that includes both the financial and non-financial sectors of each country

What is FSB?

- Financial Stability Board

- Established in 2009

- Promoting coordination among authorities responsible for addressing and stabilizing financial system vulnerabilities, etc.

- Consists of central banks, financial supervisory authorities, and ministries of finance in major countries.

- Founding Matrix of TCFD

What is NGFS?

- Network for Greening the Financial System

- Established 2017/12

- Examination of Financial Supervisory Responses to Climate Change Risks

- Composed of central banks and financial supervisory authorities of various countries

- While the TCFD focuses on the disclosure of information by general companies, NGFS focuses on how financial authorities respond.

- The composition is similar to the FSB, but the FSB is responsible for coordination at the upper level, while the NGFS is responsible for practical operations.

What is TNFD?

- Taskforce on Nature-related Financial Disclosures

- Established on 2021/6, released on 2022/3

- A framework for private companies and financial institutions to appropriately assess and disclose risks and opportunities related to natural capital and biodiversity

- Private companies and financial institutions participate

- It follows the TCFD, but while the TCFD focuses on climate change risks, the TNFD encompasses biodiversity issues.

- While TCFD focuses on assessing the financial impact of companies, TNFD emphasizes location-based risk analysis, including impacts on the surrounding environment.

What is the ISSB?

- International Sustainability Standards Board

- Established in 2021/11, official version of the information disclosure standards to be released as of the end of 2022/12

- Established as a subsidiary of the IFRS Foundation. It is positioned in parallel with the International Accounting Standards Board (IASB), which is responsible for formulating international accounting standards.

- The ISSB will follow the TCFD’s recommendations and take over the discussions. Standardize information disclosure standards

Others (CDP/CDSB/GRI/IIRC/SASB/SBT/WMB)

- CDP/CDSB/GRI/IIRC/SASB: ESG Information Disclosure Standards

- CDPとは、Carbon Disclosure Project=環境情報開示 を指す

最も多くの企業が準拠している開示基準(世界で8,361社)

企業は気候変動や森林、生物多様性、水などの環境情報に係る質問票に答える- Ref. Ref. Daiwa Securities “Disclosure Standards for ESG Information and Its Current Status” https://www.dir.co.jp/report/research/capital-mkt/esg/20210112_022016.pdf

- Ref. Ref. SMBC FG “~Special Feature~ TCFD Recommendations to Disclose the Financial Impact of Climate Change and Expand Business Opportunities” https://www.smfg.co.jp/sustainability/report/topics/detail113.html

- CDP tended to focus on environmental information such as CO2 emissions, while TCFD regarded climate change as a management issue and focused on information such as financial impacts.

- SBT refers to Science Based Targets, GHG reduction targets based on scientific evidence.

Originally, targets tended to be set from the bottom up, but we promoted top-down setting. Co-founded and operated by four organizations including CDP (2015) - WMB refers to We Mean Business, an international platform that brings together various company-related initiatives. It consists of companies and investors who are promoting measures against global warming.

- SBT, TCFD, etc. are positioned in the list of initiatives.

Ref. Ministry of the Environment

https://www.env.go.jp/earth/ondanka/supply_chain/files/WMB_20210810.pdf

- SBT, TCFD, etc. are positioned in the list of initiatives.

Many keywords and frameworks appear in discussions related to information disclosure, and I think it will be easier to understand if we focus on the relationship between them in this way.

What should be particularly noteworthy is that the G20 is trying to lobby the FSB to establish a TCFD and take over to IFRS/ISSB to standardize standards. In the first place, the flow of discussions on information disclosure was born out of concerns that climate change risks have the potential to pose a risk of a financial crisis such as the Lehman shock in the upper level of the international debate called the G20. Certainly, it would not be an exaggeration to say that if nothing is done, global warming will progress, the severity of disasters caused by climate change will accelerate, and as a result of simultaneously and frequently damaging the management of various companies, there is a possibility that the Lehman shock will come again. Therefore, with the aim of “stabilizing the financial system” as the upper level, I believe that there is a trend to encourage firms to conduct risk analysis and disclose information.

2. Organizing Discussions on Sustainable Finance

Again, sustainable finance is a general term for financing schemes that support sustainability-related activities of companies by diverting the flow of investment and loans to “sustainable” companies.

Sustainable finance, like information disclosure frameworks such as the TCFD, aims to stabilize the financial system, and I believe that information disclosure can also be positioned as a mechanism to actually motivate firms in the form of the benefits of investment and loans.

Specific schemes and frameworks include the following: Specific schemes and frameworks include the following:

- ESG Investment

- ESG investment refers to investments that take ESG factors into account, such as through scoring.

- Improving scores = encouraging companies to engage in ESG-related initiatives

- Green Bond

- Green bond refers to the procurement of bonds on the premise that they will be used for “green” projects.

- The effect of encouraging companies to implement projects that can utilize green bonds by obtaining PR effects

- Transition Finance

- Transition financing refers to financing required in the transition to a low-carbon economy.

- The effect of encouraging companies to make a transition and maintaining business continuity beyond the transition period

- Taxonomy

- Taxonomy refers to a mechanism that defines what kind of corporate activities are “green”

Sustainable finance used to be questionable. The view is that making investment decisions that take ESG into account will consider things other than the economic interests of beneficiaries, which may be contrary to fiduciary responsibility.

However, it is now a move to support it in countries around the world (e.g. in 2005, UNEP FI presented a Freshfields report stating that ESG investment should be tolerated and requested).

Against this backdrop, the European Commission (EC) established the International Platform on Sustainable Finance (IPSF) in October 2019 (a platform for international collaboration and coordination on sustainable finance). In 2020, the Financial Services Agency of Japan also joined as a member.

In addition, the Stewardship Code will be revised in 2020 to support sustainable finance.

Therefore, in 2020/12, the Financial Services Agency established the “Expert Committee on Sustainable Finance” and published a series of reports and a draft code of conduct for data providers in 2021-22.

Taxonomy refers to the mechanism that defines what is “green”, but after the taxonomy regulation came into effect in 2020/7, there has been a lot of debate about deciding on a specific list (green list).

Recently, there was a lot of talk about the European Commission’s announcement in 2022/1 that it would include nuclear power and natural gas in EU taxonomies. Originally, Germany and other countries advocating abandonment of nuclear power had argued that nuclear power generation would not be eligible for investment and loans, while France and Central and Eastern European countries should be included.

In Europe, a platform called JTP (Just Transition Platform) has been prepared in Europe, and the funding program necessary for the transition is organized.

Ref. European Commision 「Just Transition Platform」 https://ec.europa.eu/regional_policy/en/funding/jtf/just-transition-platform/

Even in Japan, the discussion of transition finance is ongoing.

In April 2022, the Ministry of Economy, Trade and Industry (METI) presented materials on the basic guidelines and roadmap for transition finance.

Recently, it has become a hot topic that roadmaps have been presented in various industries called multi-carbon emission industries.

Ref) Japan Economic Newspaper, “Responding to the ‘Decarbonization ‘Transition Period’: Government Schedules Eight Industries”https://www.nikkei.com/article/DGXZQOUB282TG0Y2A520C2000000/

While taxonomy is a move to clarify “projects that realize a low-carbon economy (e.g., renewable energy),” I think it can be summarized as a move to clarify “development investment necessary for existing businesses to transition to a low-carbon economy (e.g., development of technology to reduce firing temperature in the cement industry to save energy).”

Discussions on taxonomy and transition finance are being sorted out in Europe and elsewhere, and it is expected that the reorganization will accelerate in the Japan as well.

3. Trends in Discussions on ESG Evaluation Organizations and Data Providers

As mentioned above, on June 6, 2022, the Financial Services Agency (FSA) presented the “Draft Code of Conduct for ESG Evaluation Organizations and Data Providers.” I think that the contents written in the main text can be summarized as follows.

- ESG evaluation and data providers are becoming increasingly important

- This is because it also has a role beyond the judgment of investment and loan, such as being used for investment and loan judgment + evaluation of investment trust itself

- On the other hand, there are currently four issues:

- 1. Transparency, fairness, and comparability of evaluations

- 2. Governance and Neutrality

- 3. Human resources

- 4. Burden on companies

- この課題に対応するための原則を明文化した。

例えば(※抜粋です):- Principle 4 Ensuring transparency:

Data providers should recognize that ensuring transparency is an essential issue and clarify the methodology of evaluation. - Principle 3. Ensuring Independence and Managing Conflicts of Interest:

Data providers should make decisions independently and appropriately deal with conflicts of interest that may arise from the business, remuneration of officers and employees, etc. - Principle 2. Human resource development:

Data providers should secure specialized human resources necessary to ensure the quality of the services they provide, and should develop them within their own companies. - Principle6. Communication with companies:

Data providers should devise and improve information collection from corporate drawings more efficiently

- Principle 4 Ensuring transparency:

I believe that the key point of this discussion is how to make the framework for information disclosure and sustainable financing established for the purpose of stabilizing the financial system effective in concrete terms and substances.

Even if companies disclose information, if investors do not make investments and loans based on such information, firms will only “do it because they are told” and will not contribute to the original purpose of “stabilizing the financial system.” On the other hand, on the investor side, if the disclosed information is not comparable among companies, it will not be possible to utilize it for investment and loan decisions.

Therefore, in order to “utilize it for investment and loan decisions”, it is important to have an “ESG evaluation and data provider” that is responsible for ESG scoring and risk assessment of companies, for example. We believe that ESG initiatives are highly difficult to evaluate, as simple scoring makes it impossible to grasp the essence of risk and value, but without scoring, comparability is low. As described in Issue 1 above, how to ensure the fairness and comparability of evaluations is an important issue.

The following is a supplement to each issue and the direction of response.

1. Transparency/Fairness and Comparability

We will ensure that the investor/financial sector can and capture the essence of Apple-to-Apple comparisons between companies as much as possible (the ideal image is accounting standards). Fair company-to-company comparisons can be made under clear criteria)

→ To that end, the data provider will clarify the premise of the data (base data, methodology, etc.) and adopt a methodology that will convince as many people as possible.

2. Governance/Independence

We will ensure that the contents of corporate disclosures are accurate, taking into account third-party perspectives. In addition, we will ensure that there is no interest between the company and a third party, such as a data provider (in the same way that the accounting auditor must not have an interest with the audited company)

→ To that end, we will identify operations that may undermine our independence and reduce risks.

3. Human resources

As in the world of accounting, ESG-related evaluations require the assignment of specialized personnel to companies, investors, and evaluation institutions (data providers). On the other hand, it cannot be said that there are enough such specialized human resources in the world today, and it is necessary to increase the absolute number.

→ To that end, evaluation and data providers will become a receptacle for fostering such specialized human resources.

4. Burden on companies

In many cases, requiring companies to disclose information places a heavy burden on them. Various measures should be taken to avoid the burden on companies as much as possible.

→ To that end, the evaluation organization will devise ways to reduce the burden by presenting the evaluation policy in an easy-to-understand manner in advance as much as possible to reduce communication costs.

The direction of recognition and response to these issues is probably based on a rough consensus, and it is assumed that they will be further brushed up and established into rules in the future. In view of the movement to make it mandatory for listed companies to include information in their annual securities reports, Japan is expected that many firms will be required to conduct various quantitative evaluations in the future.

4. Looking Ahead

As you can see, various frameworks related to information disclosure and sustainable finance are now taking shape. As a company, paying close attention to such rule-making movements, making preparations in advance, and sometimes participating in rule-making discussions, will lead to ensuring the sustainability of its business and receiving benefits in terms of investment and loans. We believe that this in turn will contribute to the creation of the sustainability demanded by society, be evaluated by the market, and lead to business growth.

Summary

■Gaia Vision’s Services

Gaia Vision provides a variety of services related to the flood risks described in this article, including risk analysis of companies, support for efforts to improve resilience, and support for information disclosure related to decarbonization and climate change such as TCFD. By using Climate Vision, a climate risk analysis application, it is possible to easily analyze climate scenarios and assess physical risks in order to respond to information disclosure. If you have any problems analyzing or disclosing information on climate change risks, please contact us.

Reference material

- Announcement of the Financial Services Agency’s Second Report of the Sustainable Finance Expert Panel

https://www.fsa.go.jp/news/r4/singi/20220713/20220713.html - Financial Services Agency, “Announcement of the Draft Code of Conduct for ESG Evaluation and Data Providers,”

https://www.fsa.go.jp/news/r4/singi/20220712/20220712-2.html - Japan Economic Newspaper, Prime Minister Fumio Kishida, “Non-financial information of large companies visualized from FY23,”

https://www.nikkei.com/article/DGXZQOUA1629H0W2A710C2000000/ - NRI “Financial Stability Board Releases Roadmap on Climate-related Financial Risks”

https://www.nri.com/-/media/Corporate/jp/Files/PDF/knowledge/publication/kinyu_itf/2021/09/itf_202109_5.pdf - CFA Society Japan Webinar “Disclosure of Nature-Related Risks and Opportunities ~ TNFD Recommendations” https://www.cfasociety.org/japan/Lists/Events%20Calendar/DispForm.aspx

- Daiwa Securities “Disclosure Standards for ESG Information and Its Current Status” https://www.dir.co.jp/report/research/capital-mkt/esg/20210112_022016.pdf

- SMBC FG “~Special Feature~ TCFD Recommendations to Disclose the Financial Impact of Climate Change and Expand Business Opportunities” https://www.smfg.co.jp/sustainability/report/topics/detail113.html

- Ministry of the Environment “About We Mean Business” https://www.env.go.jp/earth/ondanka/supply_chain/files/WMB_20210810.pdf

- Financial Services Agency “Sustainable Finance Expert Panel Report – Building a Financial System to Support a Sustainable Society”

https://www.fsa.go.jp/news/r2/singi/20210618-2/01.pdf - European Commision 「Just Transition Platform」 https://ec.europa.eu/regional_policy/en/funding/jtf/just-transition-platform/

- Ministry of Economy, Trade and Industry “Transition Finance ~Overview of Basic Guidelines and Roadmap~”

https://www.jsda.or.jp/sdgs/files/roadmap1material.pdf - JETRO “Commission announces policy to include nuclear power and natural gas in EU taxonomy”

https://www.jetro.go.jp/biznews/2022/01/ac9c1a69b9dd0330.html - Wedge2020.A. “The Truth About the Decarbonization Boom”

News

- 2025年04月03日 Our technology development project as a partner organization was selected for the “Overseas Demonstration of Satellite Data Application Systems (Feasibility Study),” a technology development theme for which the Space Strategic Fund is soliciting applications from the public.

- 2025年03月07日 ADRC (Asian Disaster Reduction Center) Researchers from Asian Countries Visited Our Company

- 2025年02月21日 ADRC (Asian Disaster Reduction Center) Researchers from Asian Countries Visited Our Company

- 2025年02月17日 ADRC (Asian Disaster Reduction Center) Researchers from Asian Countries Visited Our Company

- 2025年01月29日 Gaia Vision’s efforts for river flow simulation with Kyushu Electric Power Co. reported on the Nikkei news.

Column

-

-

-

-

-